Generally speaking, the Gordon Growth Model will give you a higher value while the terminal multiple method is more conservative. Whichever method you choose will come down to whether you want a more optimistic or conservative estimate on TV. There is no one way that is better and will give you a more accurate valuation. Which Terminal Valuation Methodology is Better?

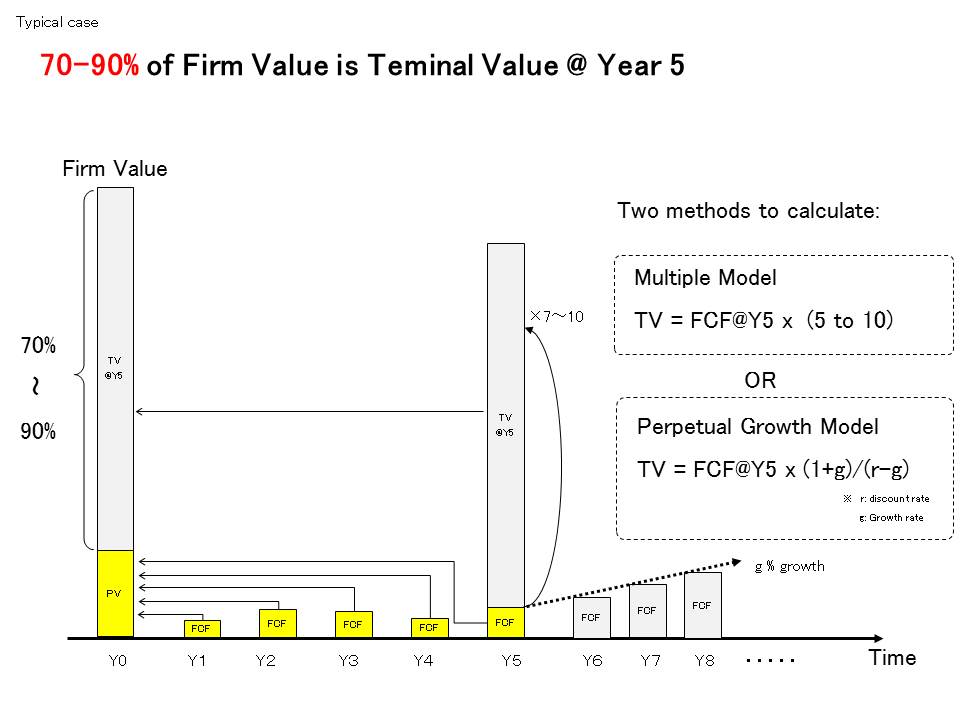

For companies like this, you use the average EBIT or EBITDA over the years, rather than the final year value as this can skew your valuation. The cash flows are then all discounted at the discount rate (WACC) and gives the implied enterprise value of the business.įor companies that operate in a cyclical industry and whose performance is dependent on the business cycle, earnings will fluctuate with the overall state of the economy. The terminal multiple is applied to the final year EBITDA (or EBIT) and is added to the cash flow of the final year. For example, if a company had an EBITDA of $5,000, the enterprise value would be $50,000 Example of Exit Multiple Method in DCF:Īn EV/EBITDA multiple of 10x would imply that the enterprise value of a company is 10x its EBITDA (earnings before interest, taxes, depreciation, and amortization). Another source of terminal multiples includes looking at precedent transactions. Commonly used terminal multiples include EV/EBIT and EV/EBITDA which can be found online or calculated from company financial statements. This method assumes that the enterprise value of the business can be calculated at the end of the projected period by using existing multiples on comparable companies. The terminal multiple is another method of calculating the terminal value. As mentioned above, the terminal growth rate should not exceed the historical growth rate of the overall economy (GDP) and should be roughly in line with inflation. The 2031 FCF is then divided by the discount rate less the terminal growth rate. The terminal growth rate is the expected growth rate of the company into perpetuity and is applied to the last forecasted cash flow to provide the first cash flow past the forecasted period.įor example, if the forecasted period ended in 2030, FCF * (1+g) would give you the FCF for 2031.

Trminal growth rate of stock tv#

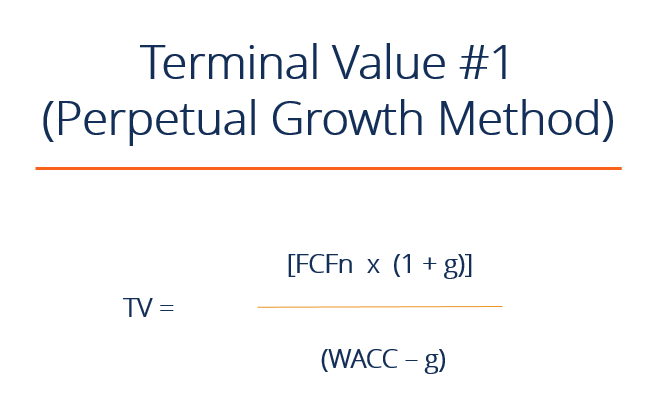

r = discount rate (usually weighted average cost of capital (WACC)īased on the formula above, we can calculate the the TV into perpetuity as:.The Terminal Value Formula under Gordon Growth Model is: The value is calculated by dividing the last cash flow by the discount rate minus the growth rate. To overcome this limitation, analysts assume that the cash flows grow at a specified constant rate.

The exact rate used, however, varies from company to company and industry to industry.Īfter a set number of years, forecasting becomes unreliable and often unrealistic, especially in high growth companies that can't sustain such rapid growth indefinitely. The growth rate for the company into perpetuity is kept constant and is usually in line with the growth rate for the overall economy as it's mathematically impossible for companies (especially established businesses in mature industries) to grow faster than the overall economy in the long term. The Gordon Growth Model (GGM) assumes that a company will exist indefinitely and is consistent with the going concern assumption of financial reporting. There are 2 main ways to calculate the TV outlined below. TV is a major component of a DCF model and will often be the largest component of enterprise value in your model. Here is a snippet from the Wall Street Oasis DCF Modelling Course to help you grasp the concepts a little better. The TV can be computed in 2 ways, the Gordon Growth Model and the exit multiple/terminal multiple method. The discounted cash flow model (DCF) is used by analysts when valuing a business and consists of 2 major components the present value (PV) of its future cash flows, and its TV beyond the forecast period. It is used in determining the value of a company into perpetuity (indefinitely) beyond the forecasted periods. The Terminal Value (TV) is the value of a business, project, or asset for the periods beyond the ones forecasted.

0 kommentar(er)

0 kommentar(er)